bull flag pattern stocks

Its what keeps the stock from rallying again. Generally speaking a bull flag pattern is very reliable depending on the context of the stock you are trading.

Bull Flag Chart Pattern How To Use In Trading Libertex Com

It is formed when there is an increase in the.

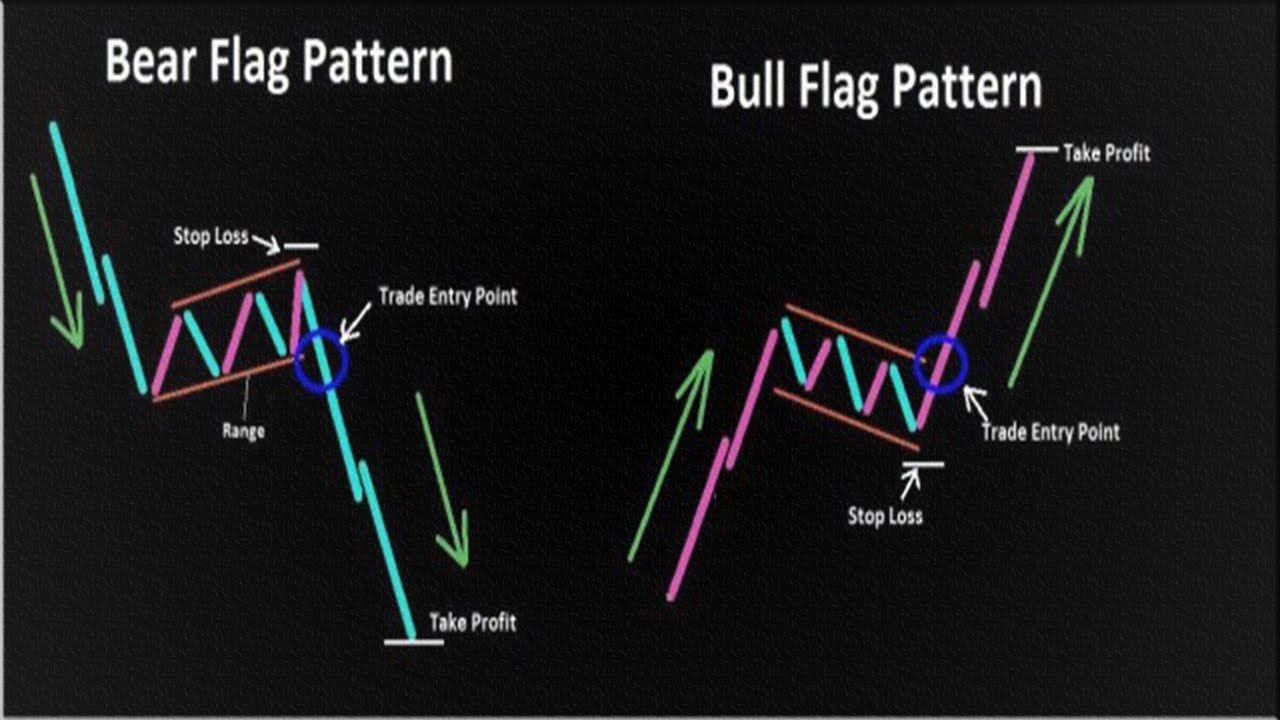

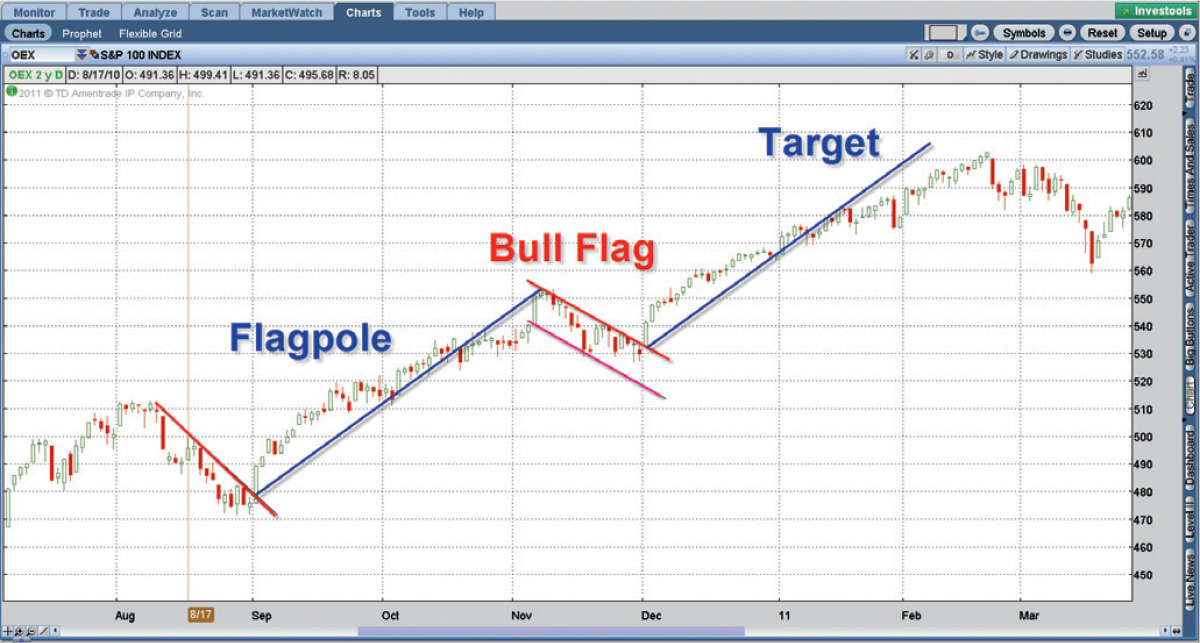

. Spotting the Bull Flag Pattern. The pattern formed by inverting the bull flag stock pattern is called the bear flag stock pattern. A bull flag is a continuation chart pattern that signals the market is likely to move higher.

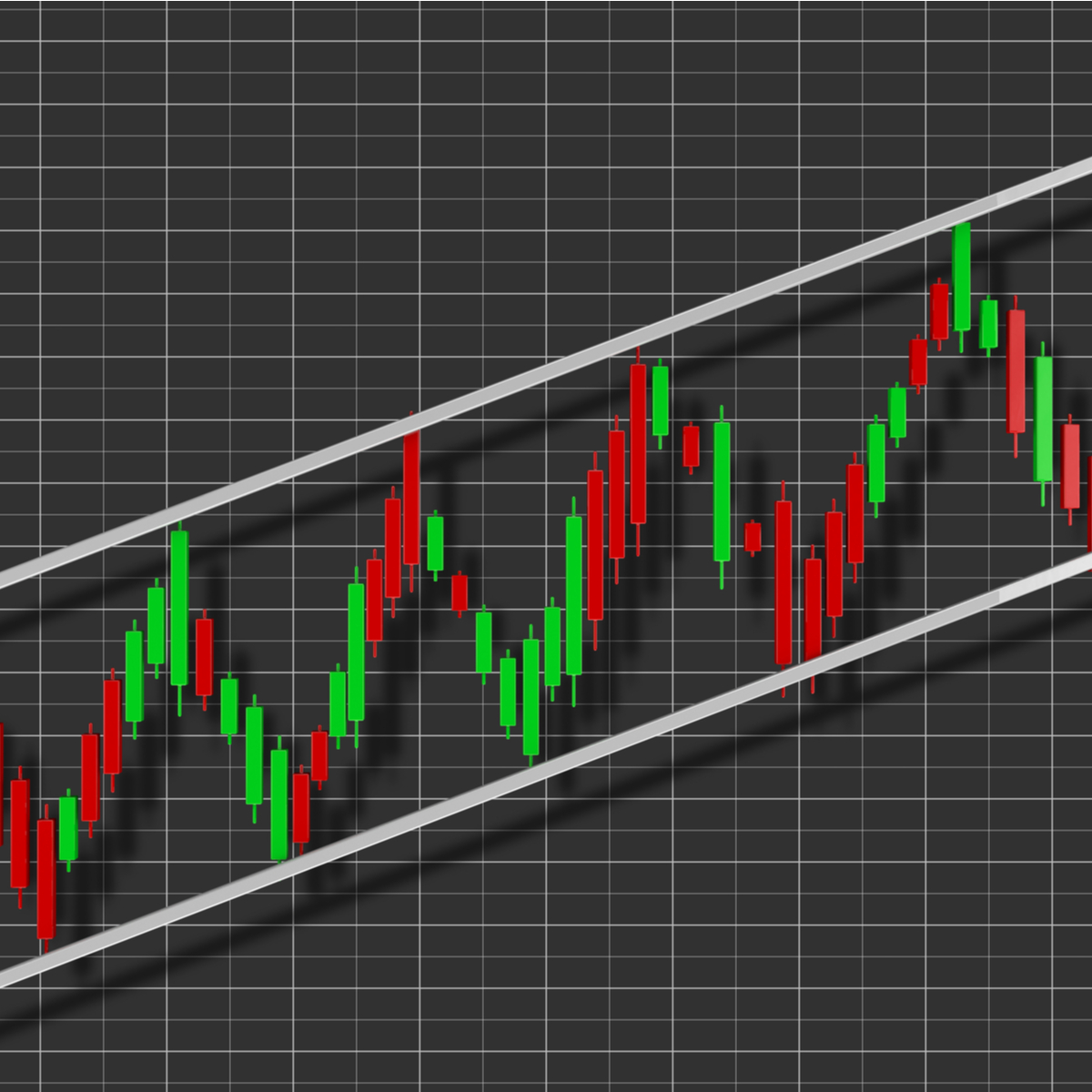

The bull flag should have an uptrend since its a continuation pattern and isnt a reversal. A bull flag is a chart pattern traders use to identify potential bullish breakouts in the market. Heres what to spot one.

The later the run and the more consolidations you have the less. The bear flag starts with a significant fall in prices followed by a period when the price remains. You dont want to.

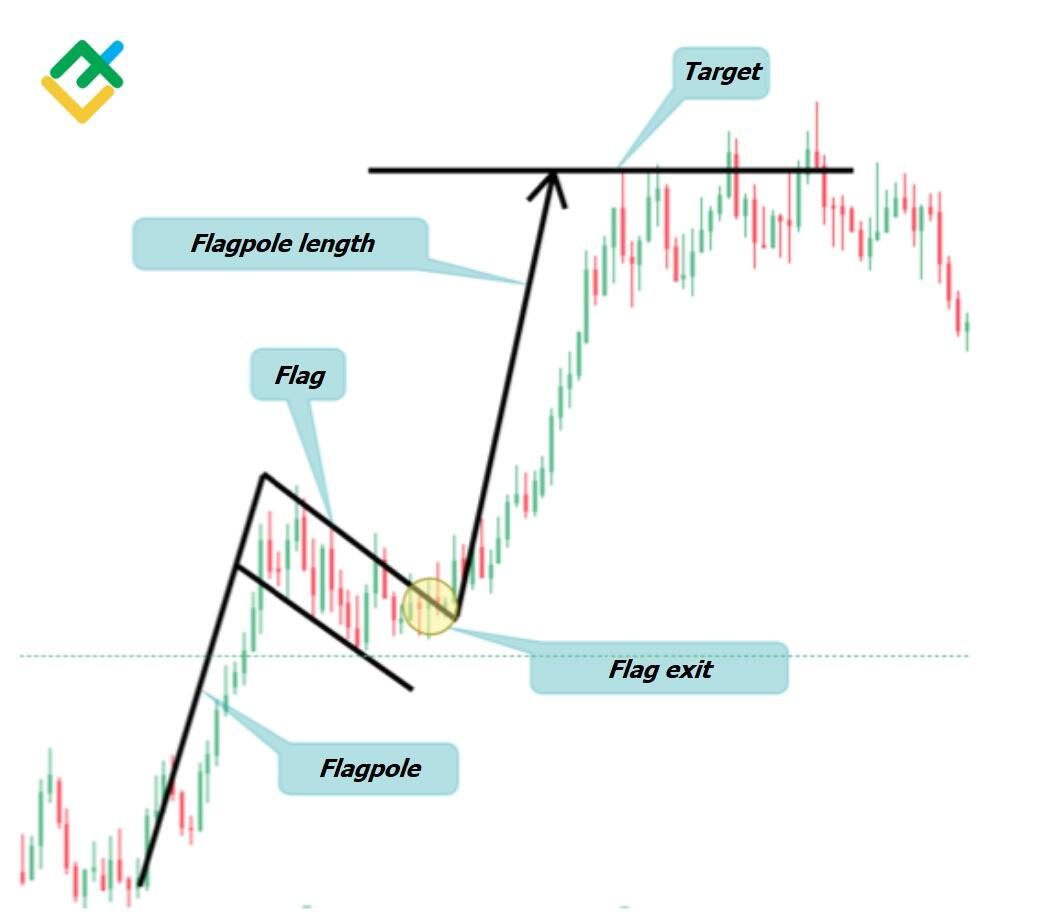

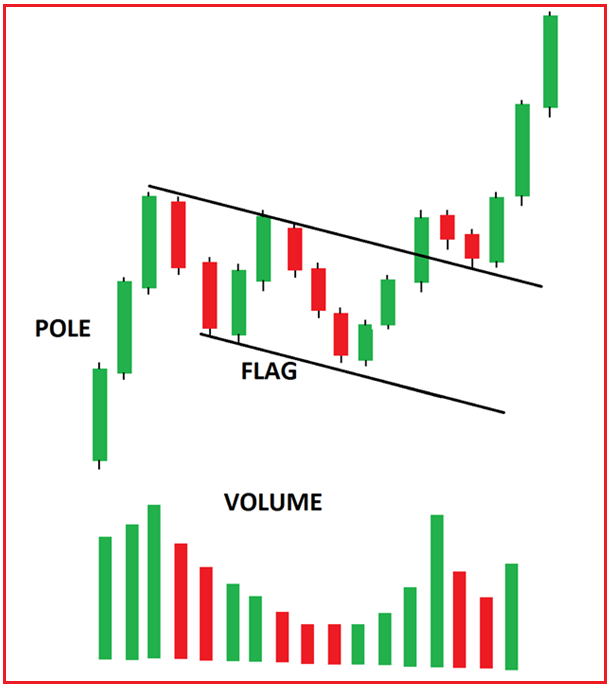

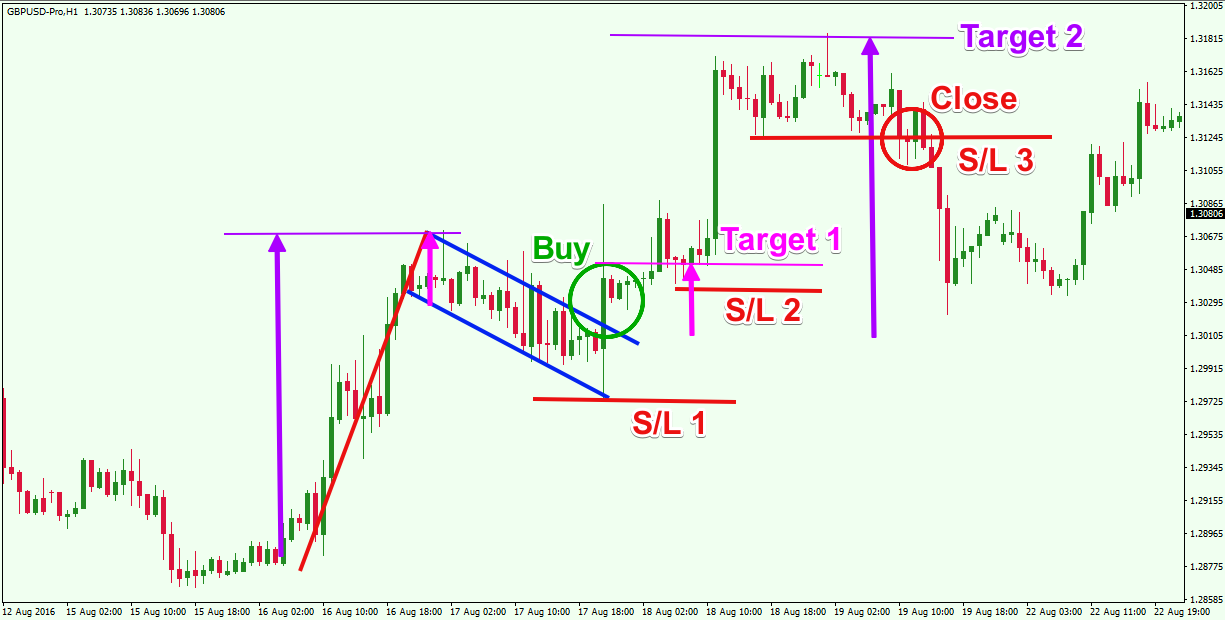

The breakout from a bull flag typically occurs when the price breaks above the. A bull flag pattern typically appears in an uptrend following a sharp rise price that extends a stock or other financial security to a new near-term high. Trading with Flag Pattern.

Traders can enter into a trade when the price breaks above or below the upper or lower flag trend lines. As mentioned earlier the bull flag is a continuation pattern. Therefore we are looking to identify an uptrend - the series of the higher highs and higher.

Below are some tips to help you Identify the bull flag pattern quickly. Here is a bull flag pattern on the SPX that fails. Look for a strong trending move This means the range of the.

A lot of traders use the bull flag pattern interchangeably with the term flag pattern. That big red candle on January 5 2022 which. The most important part of the flag pattern is to identify a strong trend in either direction as the Flag may be inverted.

How to Trade a Bull Flag Chart Pattern Step 1. The pattern is created when the price of a security rises rapidly and then falls. The resistance is the most important thing to watch on a bull flag pattern.

Pay Attention to the Resistance. A trader trading the bull flag would often put a stop just below the flag. The bullish flag formation appears.

However a bull flag or high tight flag as its sometimes called is actually a very bullish subtype of the. A bull flag chart pattern is a technical analysis tool to identify periods of increased stock prices.

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

Bullish And Bearish Flag Patterns Stock Charts

Secrets To Trading Successfully With The Bearish Flag Pattern Livestream Trading

Bull Flag Chart Pattern How To Use In Trading Libertex Com

The 7 Best Price Action Patterns Ranked By Reliability

What Is Bull Flag Pattern And How To Use It In Trading Litefinance

How To Trade Bearish Flag And The Bullish Flag Chart Patterns Forex Trading Strategies Youtube

How To Trade Bull And Bear Flag Patterns Ig Us

Stock Indexes Gap Above Bull Flag Patterns Right Side Of The Chart

Coindesk Bitcoin Ethereum Crypto News And Price Data

Are You Taking Advantage Of These 3 Bull Flag Patterns Timothy Sykes

How To Trade Bull Flag And Bear Flag Pattern Dot Net Tutorials

How To Trade Bearish And The Bullish Flag Patterns Like A Pro Forex Training Group

How To Trade Bull Flag Pattern Six Simple Steps

Stock Charting Tips Leading The Charge With Bull Fla Ticker Tape

Psychology And Description Of Bear Flag And Bull Flag For Fx Eurusd By Thetreetrader Tradingview

Bull Bear Flags Pure Power Picks Stock Options Trading Alerts